The United Kingdom is facing a major chemical resistance challenge as draconian regulatory laws see hundreds of agricultural chemicals banned.

Leading farm consultant Keith Norman, who was a presenter at the recent 2020 GRDC Grains Research Update, Perth, told the conference the UK had lost 850 plant protection products since 2001 - with 50 of those products banned in just the past eight years.

He predicted the UK would continue to lose critical agricultural chemicals over the next few years, including propyzamide, a product heavily relied upon in Australia for ryegrass control.

Glyphosate may also be banned for use in the UK, Mr Norman said, following moves by Germany, France and Austria to prohibit its use from 2021.

"The approval (for glyphosate) runs out at the end of 2021 in the European Union and the worry is, once you start getting that nucleus of countries that oppose its use, it will gain momentum and we will be in a huge predicament if we lost that," he said.

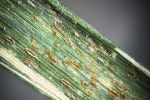

Increased risk of resistance

Mr Norman said the consequence of this super-regulated system was the increased risk of resistance as regulators attack "our armory of pesticides".

"Fewer products, more use, more selection pressure, more resistance - it is really common sense, but the regulators just don't get it.

"The regulation systems now favour active ingredients with a single point of action."

Despite this, Mr Norman said there were many non-chemical solutions in the pipeline, including:

- DNA spore sensors and 3-D leaf printers to diagnose in-crop disease;

- plant vaccines to enhance the immune system of crops;

- UV light to control disease; and

- speed breeding to produce disease-resistant wheat and barley.

New insect control options with electromagnetic induction, plus peptide insecticides, targeting one species only, would be control options used in the future, he said.

Fewer products, more use, more selection pressure, more resistance - it is really common sense, but the regulators just don't get it.

He said glucan synthase inhibitors, which attack the cell component of the disease in a plant, would also be more readily relied upon in the UK.

"The challenges keep coming and we need to get more solutions coming as well," he said.

Responding to a question from the conference floor, Mr Norman said he did not believe these tight regulations in the UK would directly affect Australian grain exports.

"I don't see a problem with wheat coming from Australia to the EU that has been treated with a product that we can't use in the EU, because a lot of the products that have been removed are not necessarily banned because they have toxic residues - but more that they don't fit the new regulation structure, which includes their potential effect on a sprayer operator, or that they are being found in groundwater," he said.

Mr Norman said floods throughout much of the UK's agricultural region had seen significantly reduced plantings throughout grain growing regions.

"There has only been about 60 per cent planted, and this (figure) reflects a range from zero on some farms in the midlands belt to about 90 per cent at best," he said.

"It has never stopped raining. We have a spring coming up now where a lot of farms are desperately trying to change their plans to put in spring crops. But the seed has run out because nobody expected the demand."

A lot of farmland would go through as fallow this year, he said.

A specialist in crop protection, Mr Norman is an independent consultant who was awarded Farm Adviser of the Year in the UK's Farmers Weekly awards in 2013.

With more than 30 years of experience in the UK's agricultural industry, he has also worked on various overseas farming activities in Spain, France, Germany, Zambia, Russia and the Ukraine.

Ag-tech not a silver bullet

Nuffield Scholar Andrew Slade told the conference that decision agriculture is the way of the future. Photo: Evan Collis

As part of his Nuffield scholarship, Western Australian grower Andrew Slade went on a global hunt to find the best digital technologies to improve the productivity of Australian agriculture.

What he found was a widespread distrust of technology and a lack of co-ordinated support systems to ensure the technology available was best-suited to agricultural challenges.

Presenting to the GRDC Grains Research Update, Perth, Andrew said his CSBP and Integro-sponsored Nuffield scholarship took him to many countries, visiting highly respected farm owners and managers who produced a range of different commodities.

On many occasions, these growers - all of whom were managing very profitable farm businesses - were not relying on technology systems in their business structures to remain profitable.

"One farmer I visited in Germany, who is part of an elite invite-only benchmarking group of European farmers, told me that a lot of the top-performing producers are tech-averse," he told the conference.

"Rather than investing in ag-tech, they are focusing on the fundamentals of business.

"Conversely, there are examples where farmers might be investing heavily (in technology) in an attempt to find a silver bullet to make up for the shortfalls in their business management."

Andrew said there appeared to be a farmer disconnect between the providers of ag-tech and the agricultural sector.

"There seems to be a lot of hype around new innovations and what they can offer to agriculture, but a lot of these innovations come from providers who are outside the sector, who have an engineering or information technology background, but they don't have a fundamental knowledge of the issues we have here in agriculture and they are not necessarily providing solutions to problems we are facing," he said.

Andrew said "tech fatigue" was a real issue in global agricultural industries.

"Even if growers are implementing a lot of new technology on-farm, their ability to manage this ag-tech and keep the technology up to date, plus ensure they are getting the most from them, is starting to diminish," he said.

"Understanding ag-tech is another skill set - which farmers are rapidly having to adapt to."

Technology on the ground

A report by the McKinsey Global Institute illustrates that, globally, agriculture has the lowest uptake of digital technology of all the major industries.

"The United States is leading the charge, spending $24 per capita on agrifood tech in 2018, with California the engine room of that growth," Andrew said.

"But compare that to $1.20 invested in agrifood tech in Australia in 2018 - our investment per capita is a long way behind these other regions."

"In an economy where agriculture contributes significantly to the gross domestic product, this is very concerning for our industry."

In Australia, significant investment in ag-tech comes from government sources focusing on start-up and accelerator projects, while in the US, investment is primarily coming from the private sector and beginning to focus on taking those start-ups and innovative solutions through to commercialisation, he said.

Production solutions

With productivity in Australian agriculture flatlining over the past two decades, Andrew believes many in the industry believed the introduction of more ag-tech innovations were the key to increasing productivity.

"Australian agricultural total factor productivity growth has been sitting at around one per cent since 2001, and a lot of that growth has come off the back of the reduction of inputs and the cutting of costs," he said.

"If we couple this with the expectations by industry bodies and government that the agricultural industry will grow to $100 billion by 2030, we have a really long way to go in order to achieve this."

Andrew said this pointed towards a reliance on digital technologies to play a major part in achieving this productivity growth.

"There is a really strong interest in our sector from digital technology companies, but there appears to be a trust issue, particularly in regard to the collection of data," he said.

Andrew warned it was now the responsibility of growers to make smart decisions about their data flow to ensure productivity momentum across all stages of the supply chain.

"A lot of data is either held by individuals or ag-tech providers - but new entrants to the market need access to this data, because without this information they cannot develop the solutions that we are looking for," he said.

"As growers, we need industry to play a more active role in developing a digital framework, in particular addressing the collection, aggregation and accessibility of farm data so that real decision-support tools can be developed."

Decision agriculture, or data that is collected by digital means, which is then analysed and used to make informed decisions, is the way of the future and holds the key to on-farm productivity gains, Andrew said.

GRDC Research Code GIA1906-004SAX