It is no secret that weeds are a major cost and constraint to grain production in Australia. In fact, weeds are the single most significant cause of crop losses globally and are estimated to cost Australian grain growers almost $3.3 billion – or about $146 per hectare – annually.

Not only is this a huge drain on the industry, but changes in the scientific, corporate and regulatory landscape over recent decades have caused a sharp decline in new herbicide development.

Taken in concert with rising frequencies of herbicide resistance, the range of effective chemical tools available for weed control has been shrinking.

In 2015, in a long-term strategic initiative, GRDC invested in a partnership with Bayer Crop Science to support and improve the investigation into new herbicide modes of action to help arm Australian grain growers in the battle for ongoing and sustainable weed control.

Declining herbicide innovation and rising resistance

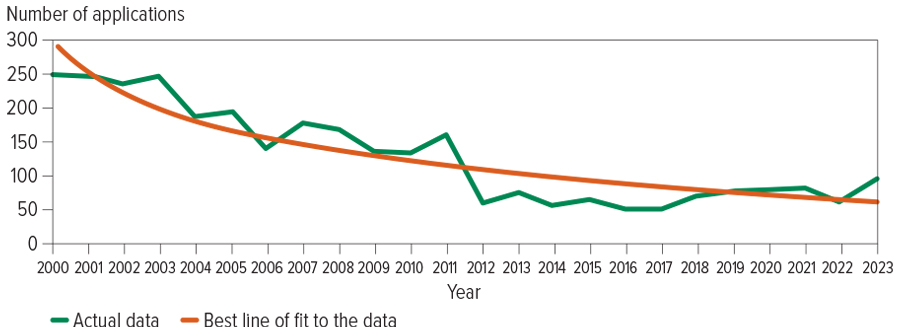

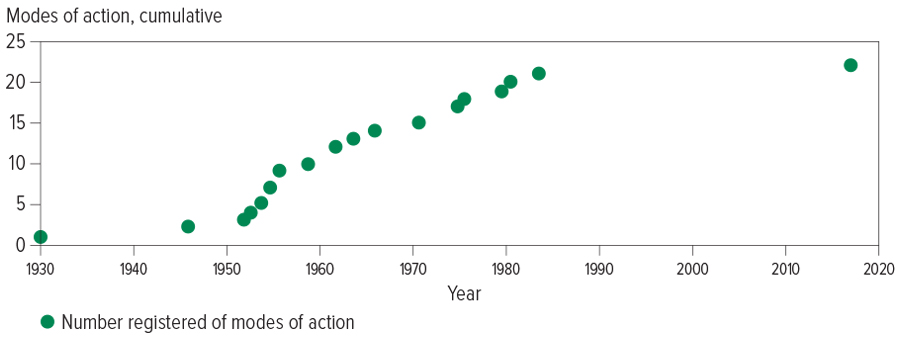

Between the 1950s and early 1990s, the global rate of patent applications for new herbicide molecules was about 250 per year (Figure 1). By the 2010s this had fallen to just over 50 per year. Additionally, no new herbicide modes of action were registered between 1984 and 2018 (Figure 2).

Several factors contributed to this decline. Increasing regulation extended the testing and approval process for new chemicals, while the successful development of genetically modified herbicide-tolerant crops increased the life and usefulness of existing chemistries.

Figure 1: Declining herbicide patent application rates 2000-2023.

SOURCE: Based on data from Bayer, GRDC and Kraehmer et al. (2014), Herbicides as Weed Control Agents: State of the Art: II. Recent Achievements, Plant Physiology.

At the same time, mergers between agro-chemical companies reduced the participants with major investments in herbicide research to just Bayer, BASF, ChemChina (Syngenta and Adama), Corteva (Dow and DuPont) and FMC.

By 2015, GRDC recognised that Australia’s specific herbicide needs would not be met if natural market dynamics were allowed to run their course.

Figure 2: No new herbicide modes of action were registered between 1984 and 2018.

Source: Based on data from Heap (2018) WeedScience.org

Market leverage for Australia

Australia’s wheat production in 2022-23 was 39.6 million metric tonnes, which represents five per cent of world wheat production (US Department of Agriculture, 2023). Other top producers were China (137.7mmt), the European Union (134.1mmt) India (104mmt) and the US (44.9mmt).

However, Australia currently has the world’s second-highest number of herbicide-resistant weed species, sitting just behind the US.

By establishing a partnership with Bayer, GRDC gained a tier-one position for Australian growers and put the specific weed control needs of Australian grain growers on an equal footing with much larger regions regarding herbicide development and commercialisation.

The partnership also helped focus research on 12 weed species of critical importance to Australian growers, including several weeds with resistance to current chemistries such as annual ryegrass, brome grass and wild radish.

Without the Herbicide Innovation Partnership (HIP), these weeds would not have featured in global priorities (with the possible exception of annual ryegrass).

Herbicides optimised for Australian conditions

The GRDC–Bayer partnership is a substantial investment that will take a long-term commitment to reach its desired outcome – new herbicide modes of action for Australian grain growers. While tens of thousands of compounds can be synthesised and tested each year, comprehensive testing for efficacy as well as human, animal and environmental safety all add time and cost.

Since 2015, the HIP investment has resulted in several promising new chemistries. Molecules synthesised by Bayer in Europe are now being tested on Australian weed species at the HIP screening sites in Horsham and other sites across the Australian grainbelt. This is a significant achievement given Australia’s relative position in the global grain industry.

Optimising new herbicides for Australian weeds and growing conditions will also increase the likelihood of their successful registration in Australia.

Lasting benefits for growers and industry

Successful commercialisation of any new herbicide mode of action can take up to 20 years after its initial discovery and GRDC’s HIP investment will take time to bear dividends.

The HIP agreement awards GRDC a share of global royalties from any successful herbicide development. This will allow GRDC to fully or partially recoup its resources and potentially support further investments.

The partnership also includes opportunities for Australian and New Zealand researchers to undertake postdoctoral research in Germany, which represents an opportunity to develop significant research and development expertise for Australian and global weed science. This ‘brain gain’ has the potential to add value to national research capabilities for decades, if not generations, not just for agriculture but also in wider chemical applications.

However, HIP’s major objective is to provide Australian grain growers with new technologies to target weeds of importance in Australian broadacre farming systems, better manage herbicide resistance, and support the sustainability of modern crop production systems for decades to come.

What modes of action have been discovered through HIP and why haven’t they made it (yet)?

Following icafolin, which in 2020 Bayer announced as its first new mode of action for post-emergent weed control in more than 30 years, Bayer’s chemists say investment in the HIP project has further diversified and broadened the portfolio of working areas, thereby allowing the discovery and evaluation of various other new modes of action.

From today’s perspective, the HIP progressed two to three molecules into the next early phase of discovery in late 2023, targeting a market entry in the mid 2030s.

Evaluating a new mode of action towards its suitability to become a herbicidal-relevant target requires ‘technical concept testing’, a distinct development phase that takes approximately five years to complete.

Its next hurdle would be to clear the ‘early research’ and ‘advanced research’ phases, which can take a further five years to complete, and establish possible first go-to-market concepts in order to justify full development costs.

Bayer’s head of chemical classes, Stefan Lehr, says scientists first look at a molecule’s efficacy when assessing its viability.

“The issue we face is that we want to have efficacy against every plant, but not the target crop. But even that is changing across the seasons (with different crops planted, resulting in different targets). It’s a time-consuming step,” Dr Lehr says.

“We also have to coordinate our field testing along with the crop growing cycles. We are fortunate with the addition of our Horsham facility, as this gives us two opportunities to test molecules each year – once in the northern hemisphere growing season and once in the southern hemisphere.”

Not all modes of action make it through even the early stages of the discovery process, for various reasons.

Those that are successful can take up to 20 years after discovery to be commercialised.

However, the long timeframe for commercial development is not due to a lack of options.

Sometimes the individual compounds have very subtle differences that can make a significant difference to performance.

Bayer’s HIP project lead, Dr Hendrik Helmke, expects the chemists in his team to each design one to two new molecules per day. The molecules are then put through a rigorous series of tests to determine their expected viability.

“New does not necessarily mean completely different, but new in the context of intellectual property and even more important in the target segment, such as grass control in cereal crops,” Dr Helmke says.

“Sometimes the individual compounds have very subtle differences that can make a significant difference to performance.”

The process of identifying, selecting and prioritising hopeful molecules also involves the work of biochemists.

Swantje Behnken, Bayer’s head of Hit Discovery Frankfurt at the time, says: “In a complementary approach, we increase efforts to try to know as much as we can about the target first, before starting chemistry synthesis work.”

It needs to be stated that numerous complexities in effectively elaborating and elucidating a mode of action as ‘new’ have to be tackled.

“It’s called the target-first approach. So, with that knowledge we can look for areas where a molecule will bind and have an effect,” Dr Behnken says.

“From that we can deduct if we’ll have a good chance of excluding unwanted activity, but still binding and having the desired effect of killing the weed.

“It’s like a funnel of wanted and unwanted characteristics.”

Signing of the Herbicide Innovation Partnership agreement in 2015 (from left): former global head of R&D for Bayer Crop Science division Adrian Percy, former GRDC chairman Richard Clarke and then Minister of Agriculture Barnaby Joyce. Photo: Bayer

This work, like that of Dr Helmke and other chemists, has received a significant boost through the HIP program.

“HIP helps us to increase the strength of our biochemistry team through having more resources,” Dr Behnken says.

“It also helps us reapply what we learn, by feeding our AI-based models which help us make the right decisions in the future, even in the early stages of designing molecules.”

Tony May, head of sales with Bayer in Australia and New Zealand, sums up the long process: “This work can take decades. It takes a long time because you’ve got to invent it, confirm that it works, and then demonstrate to regulators that it is safe and effective.”

A worthy investment: the cost of discovering a new mode of action

Discovering a new herbicide/fungicide/insecticide mode of action is a costly exercise with multiple checkpoints along the way to ensure the chemistry meets human and environmental safety standards, as well as all other regulatory requirements.

Hundreds of millions of dollars are spent by chemical companies bringing new modes of action to market – a process that typically takes well over 10 years to achieve after identification of the selected candidate.

Despite the high price tag in discovering and developing a new mode of action herbicide, it is a worthy investment as weeds are costing Australian grain growers $3.3 billion per year.

This is precisely the goal of HIP – to provide Australian growers with new technologies to manage herbicide-resistant weeds and support the sustainability of modern crop production systems for decades to come.

In 2016, CropLife International, CropLife North America and the European Crop Protection Association published a report on the cost of new agrochemical product discovery, development and registration in 1995, 2000, 2005–08 and 2010–14.

This report, which saw the authors survey leading global agrochemical companies, found the overall costs of discovery and development of a new crop protection product increased by 21.1 per cent from US$152m in 1995 to US$184m in 2000.

From 2000 to the 2005–08 period, costs increased by 39.1 per cent to US$256m. From 2005–08 to the 2010–14 period, costs increased by 11.7 per cent to US$286m.

Within these overall costs, the greatest increase has been in costs of environmental chemistry studies, which rose by almost 46 per cent in the 2005–08 period to $US35m in 2010–14. This was attributed to the rise in environmental safety data required by regulatory bodies. Field trials are the largest single cost in the development cycle at US$47m. The report also indicates that the research and development costs for the

11 companies surveyed was US$2.625 billion in 2014.

The HIP investment lifts discovery efforts and puts Australian grain growers as priority one targets for access to new herbicides at the same time as their international colleagues.