Using a consumer preference approach, Charles Sturt’s Kirsty McKenzie and Anthony Saliba are working to better understand sorghum consumption.

In Australia, sorghum is largely used as animal feed. Internationally, however, it is used in higher-value food and beverage markets.

The grain, which is an important part of the northern cropping system, has a range of attributes, such as being gluten-free, which make it attractive to consumers in increasingly health-conscious markets.

At Charles Sturt’s Graham Centre for Agricultural Innovation, and as part of the GRDC-invested ‘Expanding Options for Sorghum’ project, consumer studies have been occurring.

They aim to provide preference information on two major international markets, China and India, and to show how sorghum might meet Australian consumers’ needs.

With a psychology and consumer choice background, Dr McKenzie thinks in terms of consumer characteristics such as motivations when considering consumer markets. Professor Saliba likes to delve into the decision-making process. Both work as part of a bigger Charles Sturt team, including Professor Chris Blanchard and Associate Professor Dan Waters, to understand sorghum markets.

Here Dr McKenzie and Professor Saliba explain their approach and what it could mean for sorghum producers.

How do consumer preferences help to understand markets?

Dr McKenzie: The approach we take allows us to go beyond simple statements about market size. Obviously, current market size is a very important aspect of determining which markets to pursue, but our approach adds clarity on what you could call the ‘depth’ or ‘stability’ of these markets.

We do this by drilling down into the ‘preferences’ of the market, looking at consumers’ motivations and other underlying personality traits that impact on food choice behaviours. Some of the things we look at are food choice motives – things like health, taste, price and country of origin.

We also look at food neophobia, which is a personality trait that is related to people’s willingness to try new foods. We can think about these characteristics in relation to the actual attributes of the product.

In the case of sorghum, this might be health properties. When we combine all this with information about market size, we get a powerful picture of the consumer market and how a product fits (or could fit) within it.

Can you explain how sorghum is used in the investigated markets?

Dr McKenzie: Sorghum is the traditional grain used in the production of baijiu, a popular Asian drink considered to be the national drink of China. In India, sorghum is a traditional grain used in flatbreads.

In Australia, sorghum-based products might meet certain needs and values, such as health attributes.

In China and India, we surveyed more than 2000 consumers. And although both countries have large populations and high sorghum consumption rates, they are otherwise very different.

In China, we found that rates of baijiu consumption were high, with 55 per cent of people drinking it once a week or more.

Drinking baijiu was strongly associated with cultural values and tradition. People also believed that drinking it was healthy. This suggests that the current market is stable and market size is unlikely to decrease without some significant external disruption.

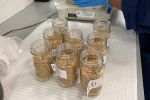

This sorghum is prepared and ready to be made into baijiu, a popular Asian drink considered to be the national drink of China. Photo: Antony Saliba.

This sorghum is prepared and ready to be made into baijiu, a popular Asian drink considered to be the national drink of China. Photo: Antony Saliba.

There is a strong association with traditional Chinese culture, with the majority of participants (85.5 per cent) believing that Chinese sorghum was vital to baijiu production’s authenticity. However, delving deeper we found most people (79.8 per cent) would be prepared to drink baijiu made using a proportion of Australian sorghum.

With this in mind, the research also explored the potential for new food products in this market. The Chinese do not have high levels of food neophobia, which means that they would be receptive to new sorghum-based products from Australia.

In India, it is still the norm to prepare food at home using traditional recipes and ingredients. Here, sorghum is a traditional grain.

Recent articles and food blogs in India have discussed its health benefits and suggested that sorghum is seen as a traditional and healthy alternative to wheat and rice. Our results backed this up.

We found that participants are choosing to eat sorghum varieties in a range of foods including in particular flatbreads, which were eaten by 87 per cent of the consumers sampled.

We also found that participants are buying wholegrain sorghum (red and white) and sorghum flour to make into flatbreads. Nearly half the sample bought sorghum once a week or more.

Health was the most important reason for choosing sorghum flatbread. This was also the most important reason why people felt they might try a new food product.

Although country of origin is not important to Indian consumers, they do have positive beliefs about food made in Australia.

Like in China, Indian consumers do not have high levels of food neophobia, indicating that they would be willing to try new foods.

Taken together, findings suggest market opportunities for Australian sorghum in India.

Here in Australia, sorghum is not widely eaten or even known about. Consumers who eat it may not be aware that they are doing so. Instead of using a survey about sorghum consumption, we conducted a series of focus groups to see how sorghum-based products might meet the needs of different segments of consumers.

This approach is based on the idea that product design, which is determined by consumer needs, will have market uptake. This includes, for example, a sorghum-based protein ball that would meet the needs of younger adults who desire foods that are healthy, convenient and transportable.

More generally, the health properties of Australian sorghum could make it really valuable in the Australian context, including for weight management and diabetes.

What does this work mean for the Australian sorghum industry?

Professor Saliba: Baijiu is a premium product and the sorghum used in it ranges in quality from high to premium. This offers a large market for Australian farmers, where the price paid is higher than the current opportunities available, namely animal feed.

Professor Anthony Saliba, left, with Dr Glen Fox, formerly at the University of Queensland and now at UC Davis, with senior technical managers at a baijiu plant in China. Photo: Antony Saliba

Other food products also require a higher quality of sorghum. This will create multiple opportunities to provide a higher-quality product with the associated higher price tag. In short, this offers the opportunity for more profit.

Our work has highlighted exciting opportunities for the Australian sorghum industry, albeit with the need for some additional coordination. Just one of these markets has the potential to take more sorghum than we currently produce, so the potential is exciting if we can get it right.