Nitrogen rates based on agronomic demand continue to drive profitability, even when urea prices triple.

Key points

- Yield and protein targets should remain the primary focus when making decisions about nitrogen fertiliser rates

- Nitrogen application is still profitable even when urea prices reach $1350 per tonne

- Soil nitrogen testing to depth and efficient application is more important than ever

Given recent nitrogen prices, growers are closely monitoring their fertiliser expenses, which typically account for about 20 to 25 per cent of total input costs. Economic calculations show target yield and protein are still the most important factor in determining profitable nitrogen applications.

The economic analysis, conducted by the Queensland Department of Agriculture and Fisheries (DAF) with GRDC investment, found that agronomically recommended fertiliser rates can still be profitable even when urea prices triple. The above-average grain prices and favourable seasonal yields have further increased profitability.

Importantly, from an agronomic standpoint, better-than-average seasons with higher yield potentials mean it is even more important to replenish depleted soil nitrogen to maintain productive capacity.

Focus on the target

While reducing nitrogen rates to overcome high fertiliser prices might seem like the obvious solution, it is not necessary as the optimal fertiliser rate is consistent despite increasing prices. The economic analysis has shown that targeting yield and protein is still the most profitable option for growers, even when the price of fertilisers increases significantly.

Using precision or variable nutrient application will also improve the effectiveness of nitrogen application.

It is important to understand how much nitrogen is already in the system to determine how much nitrogen is required to achieve target yield and protein. Growers should accurately measure existing soil nitrogen reserves using deep soil testing.

Economic calculations can then be used to compare the actual cost of fertiliser against potential profits for yield and grain price.

The average price of nitrogen is about $1 per kilogram. For every $1 spent on nitrogen, profits typically increase by $5.

For example, 40kg of nitrogen is required to increase yield by one tonne; assuming 80 per cent efficiency, 50kg needs to be applied. In the past, average nitrogen prices were about $1/kg and a tonne of wheat was worth $300.

Therefore, it would cost $50 to apply enough nitrogen to increase profit by $300 (one tonne), resulting in a profit of $250. Even if nitrogen prices triple, the cost of application will be $150 with a profit of $150.

Simulation models

Queensland DAF has undertaken price simulations at multiple locations. Results have shown that the agronomic targets remained profitable even when urea prices reach up to $1350. These calculations were sourced from two tools, CropARM and CliMate. These tools help growers and advisers consider season risk when determining nitrogen requirements.

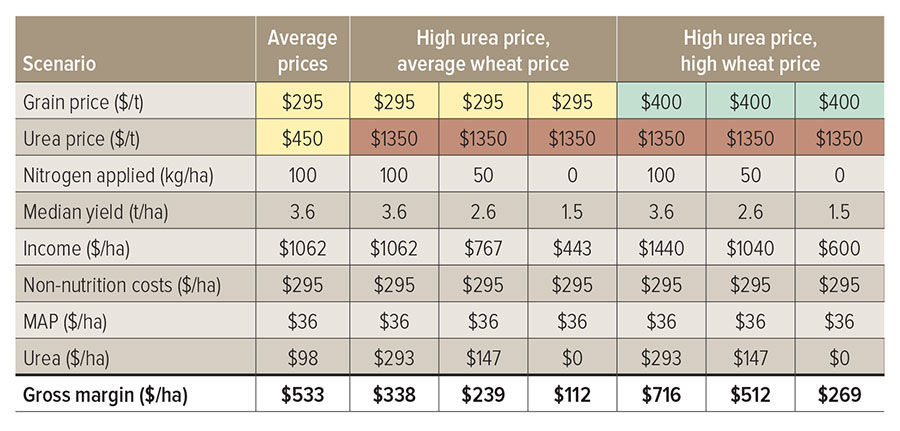

For instance, calculations showed that a Goondiwindi wheat crop achieved a gross margin of $533 per hectare when the recommended 100kg of nitrogen per hectare was applied and both urea and grain prices were average (Table 1). These calculations were based on a conservative rate of 60 per cent nitrogen recovery by the crop.

Table 1: Comparison of the impact of increased urea prices on gross margins with and without increased grain prices at three rates of urea at Goondiwindi, Queensland. The figures demonstrate that even when urea prices increase to $1350, nitrogen application at 100kg/ha is more profitable than lower rates regardless of whether grain prices are average ($295/t) or above average ($400/t).

Source: James Hagan, DAF

As urea prices have increased, the calculations showed that the gross margin reduced to $338, which is still a higher profit compared to when nitrogen rates reduced to 50kg/ha or zero. When above-average wheat prices were factored in, the gross margin increased to $716 when 100kg nitrogen/ha was applied.

These figures do not account for the legacy benefit of applied nitrogen. Research has shown that the majority of nitrogen not available in the year of application is typically available to following crops, contributing to gross margins in the following seasons.

More information: James Hagan, 0476 828 018, james.hagan@daf.qld.gov.au, ARM Online, Australian CliMate: How Wet/Nitrate?