No forecast is perfect, but the real question is whether upside benefits will outweigh downside risks.

Key points

- Top-dressing nitrogen is considered a risky decision involving a comparison of potential losses from a poor season against potential gains from a good season

- Taking the time to document upside potential versus downside can help move intuitive decisions into more concrete calculations

Top-dressing nitrogen is considered a risky decision. Too little and potential yield could be lost; too much can represent an unnecessary cost.

Growers and advisers use a range of tools to identify a target yield and then calculate the nitrogen required to achieve that yield. Some input from seasonal forecasts might be included in setting the target yield. Hitting the target yield is rare. In hindsight, a grower will almost always have under-fertilised or over-fertilised.

Decisions on application rates of nitrogen fertiliser are done by weighing up the likely upside benefits against the downside risks. These decisions are often made intuitively based on past experiences – good or bad.

Unfortunately, the human brain tends to remember negative events more strongly than positive, and often places a bigger emphasis on downside risk than is warranted. This can lead to more-conservative choices. Recent events also play a bigger role in decision-making.

To overcome this natural bias, it is useful to take the decision out of the head and objectively compare the upside and downside of proposed nitrogen rates across a range of potential seasonal outcomes.

A spreadsheet using simple nitrogen budgeting enables a potential rate to be evaluated against each possible seasonal outcome to better demonstrate the relative risk and reward.

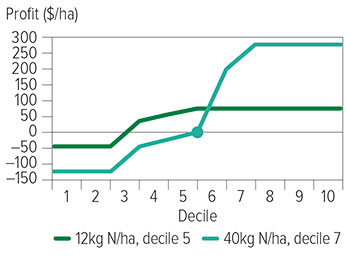

Calculations generated as part of the Australian Government’s Rural R&D for Profit Forewarned is Forearmed investment are shown in Figure 1.

Figure 1: Plotting potential profit against seasonal outcome demonstrates the relative risk and reward. The cautious choice of applying 12 kilograms of nitrogen per hectare, which is enough for decile 5, misses out on the opportunity in deciles 6 to 10 – note the flat line for higher deciles. The more-optimistic choice of applying 40kg of N/ha, which is enough for decile 7, is worse off than the cautious choice in deciles 1 to 6, but much more profitable in the higher deciles. Budgets are based on one tonne of wheat requiring 40kg of nitrogen, wheat price $400/t and nitrogen $2.80/kg plus $10 application.

Source: Dr Peter Hayman, SARDI

Potential profit is plotted against seasonal outcome – broken into 10 rainfall deciles – for two different nitrogen rates. The nitrogen rates are based on Yield Prophet® calculations of the nitrogen required to meet potential yield for an optimistic choice of season (decile 7) or the more-conservative average season (decile 5).

If the season achieves decile 7, then 40 kilograms of nitrogen per hectare are required to achieve potential yield. In that case, profit would exceed $270/ha, but this is just one potential outcome. The line representing 40kg of N/ha crosses the zero point about halfway, indicating a downside loss occurs half the time, which is more than compensated by the upside profit.

The conservative approach of applying enough nitrogen for a decile 5 season (12kg of N/ha) would be profitable more often than the decile 7 approach, but the profits are substantially lower. The probability-weighted average profit from aiming at decile 5 is $41/ha, compared to $80/ha for the higher nitrogen rate.

While Figure 1 assumes that the probability of achieving each decile is the same, these calculations can be adjusted to factor in the probabilities from seasonal forecasts.

Growers are always concerned when seasonal conditions are such that applied nitrogen is not used by the crop – usually due to drier springs. However, the evidence from research and modelling suggests that some of this nitrogen will carry over to the following season and this potential profit should be included in the calculations.

The impact of the carryover nitrogen is greatest in reducing downside regret and has a bigger impact on the more optimistic choice.

There can be no gain without risk – but the risk of missing out on potential upside profit in good seasons when they come along could be the biggest risk of all.

More information: Barry Mudge, 0417 826 790, theoaks5@bigpond.com; Dr Peter Hayman, 08 8429 0426, peter.hayman@sa.gov.au, Rapid climate decision analysis tool