Key points

- Prosperity from pulse crops will be a combination of volume and value, so Australia's R&D must cover both the production and customer opportunities

- Major trends driving global food markets are likely to favour increased consumption of plant-based protein

- Consumers are becoming more informed and vocal about their food choices and are demanding information about provenance

- Meeting new markets for pulses will require a combination of plant breeding investment and supply chain development

Increased global pulse consumption will remain based on commodity streams in the Indian subcontinent markets.

But the expected global dietary shift towards more plant protein, along with provenance stories that build consumer trust and confidence, will drive an opportunity for value rather than price to determine future market potential.

This will present Australian pulse growers and processors with an opportunity to diversify and build on existing staple food markets.

"Relying on the price-driven commodity markets for our future prosperity would be short-sighted," says Ron Storey, the chair of industry body Pulse Australia Ltd.

"From an R&D and production perspective, the message is clear: our product is good, we are a leading exporter, but standing still is not an option."

"Black Sea pulse producers and other competitors are on our heels. We need to innovate and differentiate so that price is not our only target," he says.

To address this, Pulse AustraliaLtd., with investment from GRDC, undertook a study in late 2019 of the macro trends of the global food industry to determine what the Australian pulse industry should do to capture increased value.

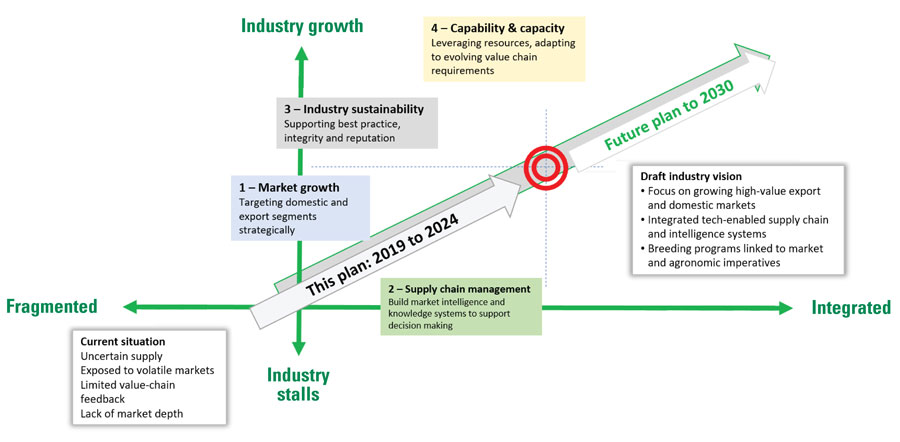

The report, Raising the pulse: the view to 2030, was released with a vision or road map for the Australian pulse industry (Figure 1).

Figure 1 Pulse road map to position Australian production moving forward to 2030.

Source: Pulse Australia Ltd

"Its purpose was to construct a road map for the Australian pulse industry to capture the opportunities which lay on that 2030 horizon," Mr Storey says.

"Rather than be distracted by background noise of short-term variables which challenge us each year, such as drought, tariffs and quotas, price volatility and so on, we wanted to take an objective look at key trends which would impact our industry over that 10-year period - something for which we could plan."

Key findings included:

- Major trends driving global food markets favour increased consumption of plant-based protein.

- Pulses will play a significant role in rapidly evolving food markets demanding more plant protein.

- Existing markets, in particular the subcontinent, will remain the backbone of the global pulse trade, while China and Africa will emerge to become larger consumers.

- Animal protein production is likely to intensify and require sustainable sources of feed and plant protein, including pulses.

- Australian pulses have earned a strong position due to the breeding and supply chain focus on clean, quality grain with desired visual characteristics.

Consumer driven

Mr Storey says Australia needs to develop supply chain systems for its pulses that authenticate the clean and green image, and also strengthen connections between growers and consumers to build sustainable and profitable relationships.

Consumers are loud and clear: what they eat matters. They demand evidence of food provenance - where it was grown, how it was grown, how safe and wholesome it is. With Australia's 'clean and green' reputation, this is a fantastic opportunity for us.

"To develop differentiation characteristics in our pulses to meet consumer demand, Australia should look closely at defining pulse functionality traits which meet these needs. This is both a breeding and a supply chain issue," he says.

Finally, while capturing new market opportunities is critical, it must be accompanied by crops that are profitable for growers. Pulses were a novel crop to Australian growers in the 1990s. In 2010, pulses represented five to six per cent of cropping area; in 2020 this has risen to almost 10 per cent.

"Farmers are voting with their feet, their soils and their wallets, so the hard work on yield, disease and weeds needs to continue in the paddock," Mr Storey says.

"Ultimately, prosperity from pulse crops will be a combination of volume and value, so R&D must cover both the production and the customer opportunities."

More information: Ron Storey, ron@storeymarketing.com.au, 0418 332 431

Raising the pulse: The view to 2030 for Australian Pulses – Opportunities and Challenges