With the introduction of transformative innovations in the late 19th century, such as the stump-jump plough and the self-propelled Sunshine combine harvester, the Australian agricultural industry legacy of innovation has been remarkable.

This imperative to continue innovating remains as important as ever, as the industry seeks to enhance crop productivity, adapt to shifting climate patterns, address sustainability concerns, and navigate the evolving nature of the grains industry workforce.

For 31 years GRDC has supported Australian growers by investing in research, development and extension for growers’ benefit boosting profitability and sustainability.

In 2019 GRDC introduced an investment innovation partnering with Artesian Venture Partners, Australia's largest and most active early-stage venture capital firm, to form the GrainInnovate venture capital fund.

The success of the fund is the combined industry awareness of GRDC with the investment expertise of Artesian. Artesian’s director of agrifood, Robert Williams, says "The partnership between GRDC and Artesian is an example of a unique approach where institutional investment joins forces with industry to collaboratively identify key challenges faced by growers and to deploy capital into startups that are developing innovative and commercial solutions to these challenges. As the portfolio develops, GrainInnovate continues to scale the impact it is delivering for the benefit of growers and the industry as a whole."

Patient investment

The GrainInnovate fund uses a one-off investment of $25 million, spread over five years, from GRDC with matching co-investment by Artesian.

Key criteria for GrainInnovate support of a company are the uniqueness of the technology it is developing, whether it fills a gap in the agtech marketplace that will directly benefit Australian grain growers, and the enterprise’s risk profile. GrainInnovate is a minority investor, leveraging co-investment with reputable, knowledgeable, local and global funds.

The fund takes a patient approach, investing from seed to growth stage in agtech startups. Agtech development can require an annual cropping season to evaluate each prototype. This means that a longer-term investment timeline is required, together with staged investment as the agtech grows and achieves key milestones.

Portfolio

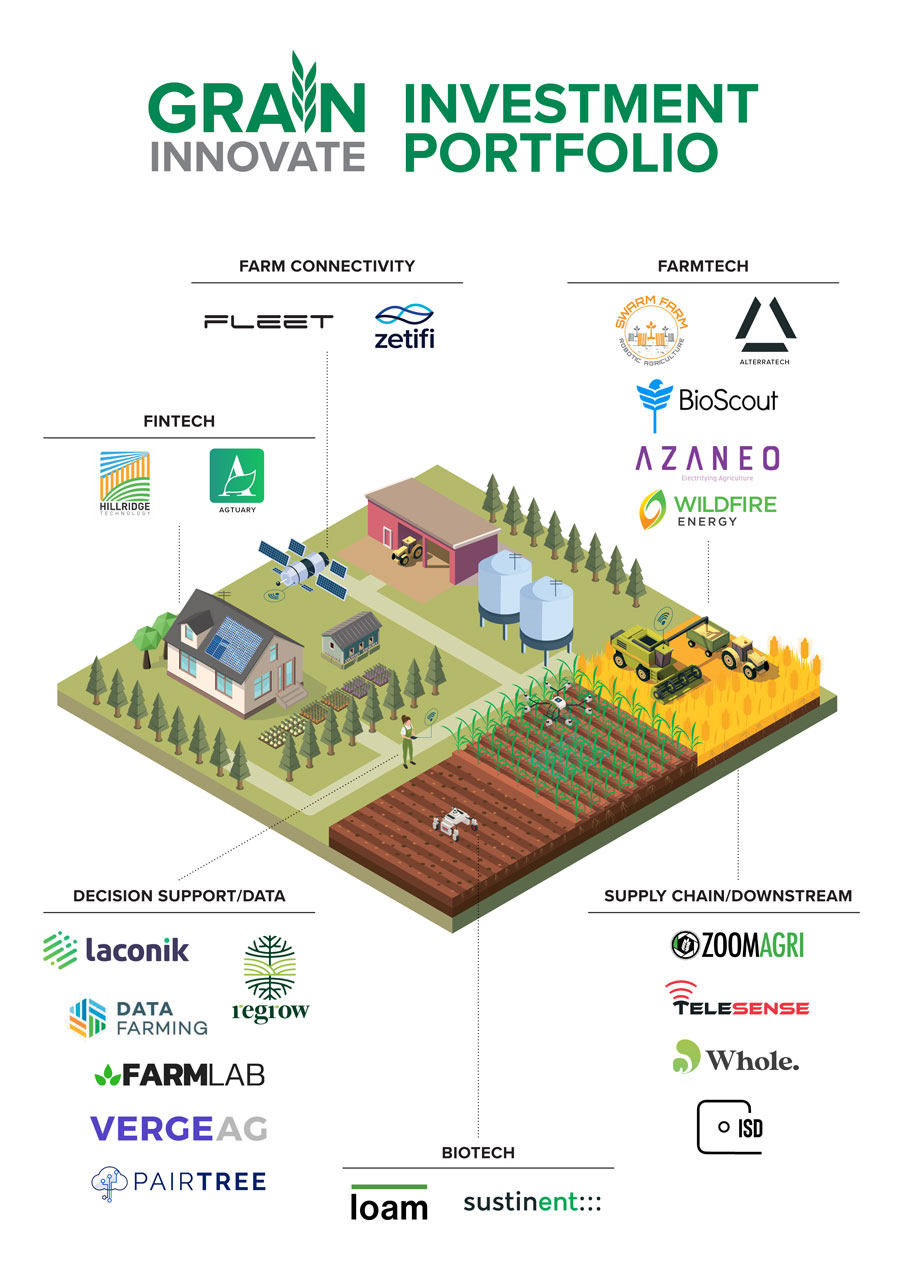

To ensure the fund’s overall success, a broad ‘portfolio’ approach has been taken with investments across diverse fields in multiple businesses. To date 21 startup companies – with interests ranging from farm connectivity to digital agriculture, weather risk management, biosecurity, and field robots – have received investments ranging from $50,000 to $2.5 million.

Infographic illustrating the nature and breadth of GrainInnovate investments. Source: GRDC

A selection of these is showcased in this Groundcover™ Supplement number 165 ‘GrainInnovate’; VergeAg, SwarmFarm, DataFarming, Hillridge, Pairtree Intelligence, Farmlab, Zetifi, Bioscout, Laconik, LoamBio and ZoomAgri.

User case studies are paired with most of the startups and a significant new GRDC investment, Frost and Heat Management Analytics (FAHMA) demonstrates how agtech startups and GRDC’s traditional research partners can converge capabilities to assist decision-making for growers dealing with climatic constraints.

The GrainInnovate investments bring new people with new capabilities, passion and purpose to the grains industry. Their innovations share a common focus on solving grower challenges with innovative technology. The new technology will power more profitable, efficient operations, and safety for growers together with enabling different ways of doing research to support growers.

More information: Tim Spencer, tim.spencer@grdc.com.au